CCCEU, CEIS Jointly Release "Greening Europe: the Report on Development of Chinese NEV Manufacturers in Europe" in Brussels

82% of surveyed companies said EU's anti-subsidy probe led to decline in confidence in investing in Europe; 73% said investigation negatively impacted sales in Europe

Businesses urge prompt Europe-China dialogue and consultation

Brussels, June 19, 2024 - A report entitled "Greening Europe: Report on Development of Chinese NEV Manufacturers in Europe" (the Report), co-authored by the China Chamber of Commerce to the EU(CCCEU) and the China Economic Information Service (CEIS) , was officially released today in Brussels, Belgium. Based on extensive survey research, in-depth interviews and field visits, the Report examines the development of Chinese new energy vehicles (NEV) manufacturers in the European market and makes constructive suggestions for China-Europe automotive cooperation.

According to the Report, the EU's decision to impose provisional countervailing duties on Chinese electric vehicle (EV) has harmed the confidence of Chinese EV investors operating in Europe, as well as the bloc's business environment. The Report argues that the competitive advantage of Chinese EVs stems from a free and competitive domestic market. Chinese automakers have capitalized on green transition opportunities, putting themselves ahead of the competition. The Report urges Chinese and European automakers to work together more closely to expand the EV market and contribute to the global green economy transition.

The EU's proposed temporary countervailing duties far exceed the capacity of relevant enterprises, set to create a severe market barrier. Since the commencement of the investigation, there has been a noticeable detriment to the sales and reputation of Chinese new energy vehicle enterprises operating within Europe. This adverse situation has eroded the confidence of Chinese automotive manufacturers in their European ventures, negatively impacting the European commercial environment. Additionally, these measures are anticipated to decelerate Europe's transition towards sustainable practices, adversely affecting the objectives of the "European Green Deal." The imposition of such duties not only compromises the interests of European consumers and equitable business practices but also sends a detrimental signal of protectionism to the global effort towards a green transition.

Xu Chen, the CCCEU Chairman and Chairman of Bank of China (Europe), stated that Europe has once played a critical role as a leader and rule-setter in the green sector, facilitating the establishment of a global vision for dual-carbon goals. Meanwhile, China has become an indispensable global force in reducing emissions, transitioning energy, and achieving sustainable objectives. The EU's anti-subsidy investigation into Chinese EVs represents a turning point in EU economic policy, signaling a shift towards inward-looking tendencies. As globalization subtly evolves, with accelerated trends in near-shoring and friend-shoring of supply chains, the "Spaghetti Bowl" effect of intricate trade rules has become more pronounced, leading to new strategic choices for the EU amid the century's pandemic, geopolitical conflicts, and major power struggles. However, this choice by the EU has put businesses, including members of the Chamber, at the forefront in the new energy sector in Europe. "We can feel the pressure and concerns within the industry. We hope that the efforts of the EU and Chinese business communities will converge, objectively viewing the contributions of Chinese companies to the green transition in Europe and globally, and genuinely aiding the construction of a China-EU green partnership," Xu said.

"Through our research, we found that the market share of Chinese brand electric vehicles in Europe has been selectively exaggerated, and the anti-subsidy investigation is a 'lose-lose' situation for both China and the EU." Ji Lei, Vice President of CEIS, General Manager of CEIS Shanghai said that the Chinese and European automobile industries have been working together for 40 years, expanding cooperation in a healthy competition and achieving a win-win situation is the optimal way to get along. We look forward to closer cooperation between the EU and China in the field of new energy vehicles and jointly promoting the development of the green economy.

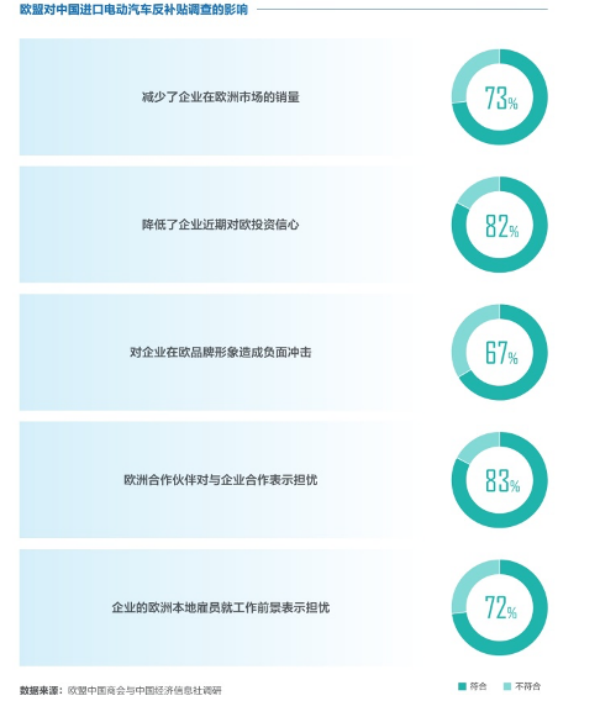

EU Anti-Subsidy Probe Lowers Investor Confidence: 82% of Surveyed Companies Affected

In October 2023, the European Commission (EC) opened an anti-subsidy investigation into Chinese EVs. On June 12, 2024, the EC announced provisional measures, including plans to levy temporary countervailing duties ranging from 17.4% to 38.1% on EVs originating in China starting in early July.

To gain a true picture of Chinese automotive businesses in Europe and assess the impact of the anti-subsidy investigation, the CCCEU and CEIS conducted a survey and in-depth interviews with over 30 NEV businesses and institutions beginning in April and May.

According to the Report, following the EU's announcement of the anti-subsidy investigation, 73% of the surveyed Chinese NEV manufacturers reported a decrease in sales in the European market, while 67% said their brand reputation suffered. Furthermore, 83% of the surveyed companies reported that their European partners were concerned about cooperation prospects, resulting in a significant drop in enthusiasm and collaboration among various dealers and leasing companies. Moreover, 82% of the respondents said they felt less confident about future investments in Europe, and 72% said their local workers there were concerned about their employment opportunities.

A breakdown of survey results

The survey results show that most respondents believe geopolitical factors have led to a noticeable trend of politicizing economic activities. The imposition of the anti-subsidy tax is expected to significantly increase costs and complicate business operations, undermining the EU's efforts to create a favorable green economic environment.

Despite these challenges, the majority of the respondents reaffirmed their commitment to "in Europe, for Europe." Notably, 67% of the respondents emphasized that the European market remains crucial to their global strategy, with hopes of building factories in Europe within the next five years. Many companies also plan to hire employees in Europe in 2024.

The Report also notes that since the start of the anti-subsidy investigation, government officials, automotive executives, and academic experts from various European countries have voiced opposing opinions. Many believe that such measures will undermine the long-standing cooperative foundation and shared interests of the Chinese and European automotive industries. Some European automotive firms have explicitly stated that the investigation is unlikely to improve the competitiveness of European brands and may hinder the transformation of established European automakers and the EU's efforts to meet its zero-carbon targets.

The Report debunks multiple allegations about Chinese EVs

The Report refutes allegations such as "China's dumping of low-cost EVs," and Chinese EV industry's "reliance on subsidies," and "overcapacity" through comprehensive research and data analysis of the industry chain.

The market share of Chinese EV brands in Europe has been "selectively" exaggerated. Analyzing data from the Chinese automotive industry, customs, and several global authoritative analytical institutions, the Report reveals that Western brands still dominate Chinese EV exports to Europe. According to Transport & Environment, Tesla accounts for 28% of Chinese EV exports to Europe, while Renault-Dacia accounts for 20%, with Western brands accounting for over 50%. JATO Dynamics' data indicates a month-by-month decline in the registration of Chinese brand electric vehicles in the European market since the beginning of 2024. Imposing a provisional anti-subsidy tax would harm both Chinese and European manufacturers, as well as European consumers.

The allegation that China's NEV industry suffers from overcapacity is unfounded. According to the International Energy Agency, in order to achieve carbon neutrality by 2030, global NEV sales must reach 45 million units—more than three times global sales in 2023 and nearly five times China's production that year. There is a severe shortage of NEVs, not an abundance, given the global urgency of a green and low-carbon transition. Additionally, product exports do not imply overcapacity. In 2023, around 80% of German automobile production and 50% of Japanese automobile production were exported, whereas China's NEV exports accounted for only 12.7% of its production, with sales to the EU accounting for merely about 5%. The current global capacity structure is the result of market dynamics and economic globalization, reflecting the necessary division of labor and resource optimization based on the comparative strengths of individual countries.

China has already phased out subsidies for EV purchases, and its NEV competitive edge stems from an open, competitive market. To encourage the growth of the NEV industry, major economies such as China, the United States, and the EU have introduced purchase subsidies and support policies. However, unlike the EU and the United States, which continue to provide significant purchase subsidies, China's subsidies for NEV purchases had already been phased out by the end of 2022, following several years of gradual reduction. The Report cites research indicating that some European countries provide more extensive and generous subsidies than China did.

The Report calls for strengthening cooperation to decarbonize transport and facilitate green economic transition

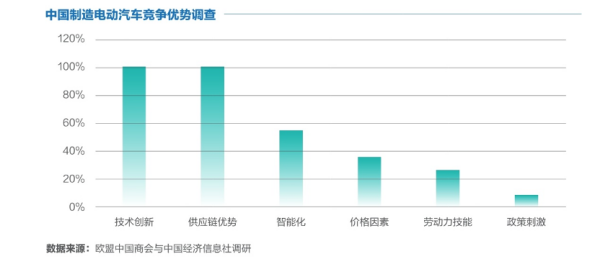

According to the report, Chinese NEVs have a competitive advantage thanks to an open, competitive market environment. China has steadily increased its openness, allowing European and American automakers to fully capitalize on the Chinese market's growth. In order to catch up with established global giants, emerging Chinese automakers have seized opportunities for green transition, leveraging China's robust supply chain and intelligent infrastructure to gradually gain a competitive advantage.

China leads the world in the number of EV patent applications, with long-term R&D investments establishing its leadership in power batteries, motors, electronic controls and intelligent technologies. UBS Securities' 2023 teardown of BYD's Seal model concluded that the cost competitiveness of Chinese EVs is driven by technological innovation, process improvements, and simplified engineering design, rather than merely lower production costs.

A breakdown of survey results

China's automotive industry has formed six major clusters centered on leading enterprises like FAW Group, Dongfeng Motor Corporation, SAIC Motor, and new energy players like Tesla and BYD. Building on its established fuel vehicle industry, China's NEV sector has developed a comprehensive industrial chain encompassing material R&D, engineering design, manufacturing management, and assembly. This ecosystem is driven by automakers and leverages advanced intelligent connected technologies.

By the end of 2023, the total number of charging facilities in China reached 8.596 million , with public charging exceeding 80% in 17 major cities like Shanghai. In contrast, the EU had around 630,000 public charging stations, falling far short of the European Automobile Manufacturers Association's (ACEA) prediction of needing a staggering 8.8 million by 2030 to meet consumer demand.

The Report concludes that the growth and development of China's automotive industry are inseparable from foreign investment and international cooperation. It recommends that China and Europe collaborate by leveraging their respective strengths in the green industry, while respecting the global division of labor within the green industrial chain. This full value chain cooperation would significantly promote the global green transition.

The Report suggests that future cooperation between China and Europe in the automotive sector could focus on technology, infrastructure development, and mutual recognition of standards. It emphasizes the importance of respecting mutual interests and concerns, and fostering a transparent, fair, and clear investment environment with streamlined regulatory procedures. It believes that China and Europe have a unique opportunity to transform the current supply chain into a "win-win" opportunity through collaboration.

- End-

To read the report, please click the link here:

https://liveshare-sh.cnfic.com.cn/activity40/#/home

To access photos of the launch event, please click here:

https://as.piufoto.com/album/1157450408/?from=link&menu=live

About the China Chamber of Commerce to the EU (CCCEU)

Established in Brussels in August 2018, the CCCEU promotes China-EU economic and trade activities, fostering a better business environment for Chinese investors in Europe and expanding trade opportunities. With a mission to facilitate China-EU commerce and create shared prosperity, the Chamber has over 100 members, including 21 member chambers in EU member states, representing over 1,000 Chinese enterprises in Europe.

About the China Economic Information Service (CEIS)

The CEIS is a professional provider of economic information in China. CEIS offers a comprehensive suite of services to over 100,000 institutions and 30 million individual users worldwide, including news, data, reports, industry analysis, public opinion monitoring and consultation.

Login

Login Login

Login CCCEU and Gunnercooke Successfully Host Webinar on CSDDD and FLR Compliance to Guide Chinese Businesses

CCCEU and Gunnercooke Successfully Host Webinar on CSDDD and FLR Compliance to Guide Chinese Businesses Cultivating responsible China-EU business leaders essential to tackling global challenges

Cultivating responsible China-EU business leaders essential to tackling global challenges