CCCEU Report: Chinese Business Expands in EU Amidst Growth, Yet Sentiment Slips to 4-Year Low with Slower Pace

Survey Reveals 63% of Chinese Firms Grapple with the EU's "De-risking" Approach, While Over 80% Set Sights on Expansion in Europe

-BRUSSELS, Nov.14, 2023—China Chamber of Commerce to the EU (CCCEU), in collaboration with Roland Berger, released the chamber's annual flagship report titled "Building Trust, Boosting Prosperity--CCCEU Report on the Development of Chinese Enterprises in the EU 2023/2024" in Brussels, Belgium.

Despite the headwinds from global economic turbulence and geopolitical influences, the report highlights the resilient growth of Chinese enterprises in the EU. However, these enterprises have observed that the EU's "de-risking" approach, coupled with a series of policy measures, introduces uncertainty to economic and trade cooperation and bilateral relations. Their evaluation of the business environment for Chinese enterprises in the EU has seen a continuous decline for the fourth consecutive year, albeit at a slowing pace. Despite the challenges faced by Chinese enterprises in the EU, they express a continued willingness to cultivate the European market.

Based on the findings, the report advocates for the EU to steer clear of politicising critical business matters, particularly in pivotal domains like information and communication technology (ICT), electric vehicles, and renewable energy. Emphasising the need for collaboration, it urges both China and the EU to capitalise on the positive momentum of resuming exchanges at all levels this year. The report underscores the importance of bolstering mutual trust to collectively address global challenges encompassing geopolitics, climate change, and crises in energy and food security. Furthermore, it calls for concerted efforts towards the sustainable development of trade, investment, green industry, and the digital economy.

In a forward-looking approach, the report encourages collaborative endeavours between China and the EU to foster the sustainable growth of their respective economies, trade, investment, green industries, and digital economies. Such cooperation is envisioned to contribute to the mutual prosperity of the Chinese and European markets, fostering a symbiotic relationship for shared success.

Mr. Xu Chen, the CCCEU Chairman, delivered the opening remarks. He said that in 2022, Sino-EU economic ties hit a milestone, emerging as each other's second-largest trading partners, with daily trade surpassing EUR 2 billion. Traditionally dominated by electronics and automobiles, bilateral trade now sees a notable surge in high-tech and green products like solar panels and electric vehicles. For Chinese businesses, the European market is pivotal, serving as a key investment destination. Their establishment of R&D and data centres, cybersecurity hubs, and battery plants in countries such as Germany and Hungary contributes to local economies, job creation, and innovation for sustainable growth. "At a time when the world faces a trust deficit, Chinese entrepreneurs are ready and willing to cooperate with the EU stakeholders. We aim to contribute to the steady and sustained development of China-EU economic and trade relations. Our shared future is brighter when we brace for more collaboration, communication, and understanding of each other," he added.

Dr. Li Bing, partner of Roland Berger, extended congratulations on the publication of this year's flagship report via video link. Dr. Li said that "this is the fifth year that Roland Berger and the CCCEU team up to survey the business environment in the EU for Chinese enterprises. Although external pressure and challenges exist, Chinese enterprises are increasingly optimistic about their long-term business prospects in the EU. Out of the nearly 180 enterprises we surveyed or interviewed, 90% reported a revenue increase in the EU, significantly higher than the 70% from last year. About 80% of them have plans to invest more in the EU, signifying their long-term dedication to the EU market. The numbers speak for themselves. With confidence, many Chinese enterprises and their European partners are stepping up exchanges in innovation, creating new markets, and optimising collaboration in such strategic emerging sectors as the digital economy, the green economy, and research and innovation. We hope that the suggestions we put forward in the report will serve as a constructive reference to facilitate communication and win-win cooperation between China and the EU."

The report was finalised over a span of approximately four months, encompassing surveys conducted from July to October that involved around 180 Chinese companies and organizations. It also covers critical topics such as green collaboration, digital partnership, and technological innovation. Its final chapter outlines 170 detailed proposals and recommendations across nine distinct perspectives.

The event, moderated by Mr. Fang Dongkui, Secretary General of the CCCEU, featured insights from Mr. Yu Zenggang, Council Member of the CCCEU and Chairman of Piraeus Port Authority S.A., on Chinese companies' engagement in the green economy and ESG. Ms. Wen Han, Chair of the CCCEU Digital Working Group and Chief Representative to the EU Institutions, Vice President of Public Affairs for Europe, Huawei, provided perspectives on Chinese companies' practices in the digital economy. The report was presented by Ms. Yang Xiaohong, Senior Project Manager of Roland Berger. During the QA session, Mr. Yu, Ms. Wen, Ms. Liang Linlin (CCCEU Director of Communication and Research), and Ms. Yang Xiaohong addressed journalists' questions.

Surveyed Chinese Companies: Growth in 2022, Anticipating Expansion in 2023

The report highlights that Chinese enterprises consistently contribute significantly to the EU in terms of tax income, greenfield investments, employment, and technological innovation. Despite challenges such as energy crises and high inflation leading to increased production costs for Chinese enterprises in Europe, the overall trend of the European green, energy, and digital transformation presents opportunities for development. In a comprehensive view, Chinese enterprises in Europe have maintained robust growth, with approximately 90% of surveyed companies reporting increased revenue. This figure surpasses approximately 70% from the previous year, with around 20% of surveyed enterprises indicating a "significant increase" in revenue.

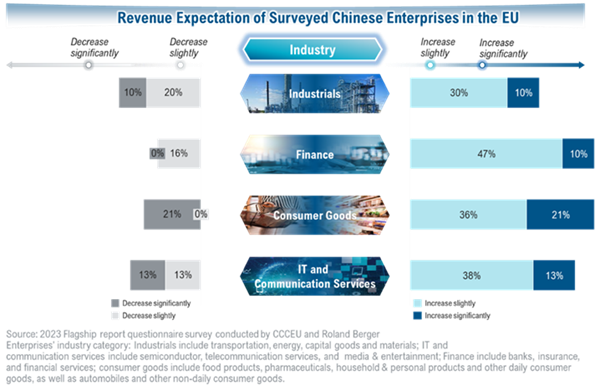

Encouraged by such positive factors as restored offline exchanges in 2023, Chinese enterprises are optimistic about their revenue prospects in 2023. Specifically, 58% of respondent enterprises, higher than last year's 40%, expect their 2023 revenue to "increase slightly" or "increase significantly" in 2023, signifying optimistic prospects for Chinese enterprises in the EU. However, taking into consideration the persistently high inflation, exacerbated geopolitical tensions, and the EU's inclination towards "turning inward," Chinese enterprises in Europe are cautiously optimistic about their business in 2023. According to surveyed companies, the enforcement of de-risking policies is heightening pressure on Chinese companies, notably in critical sectors like ICT and new energy. Our survey shows that 72% of respondant companies reported that they have felt the impact. The EU's designation of Chinese firms as high-risk vendors in ICT without evidence and the initiation of an anti-subsidy investigation into Chinese electric vehicles are seen as violations of EU's free trade principles. These actions are eroding the confidence of Chinese companies in continuing operations in the EU, they added.

Greenfield investment overtakes mergers and acquisitions (M&A) and has become the major form of Chinese investment in the EU. In recent years, as the EU tightens M&A investment policies and more EU Member States adopt FDI screening mechanisms, Chinese enterprises seeking M&A face amplified time, compliance costs, uncertainties, and political barriers. This shift has prompted a more cautious approach, redirecting focus towards "safer" and more accessible greenfield investments. Our survey indicates that 19% of respondent Chinese enterprises have initiated greenfield deployments in the EU. Notably, Contemporary Amperex Technology Co., Limited (CATL) unveiled plans in August 2022 to invest EUR 7.34 billion in constructing a 100 GWh electric vehicle battery plant in Debrecen, Hungary. Furthermore, in August 2023, Automotive Energy Supply Corporation (AESC) stated that its manufacturing base in northern France had entered the critical phase of main structure construction and would start operation in 2025 as scheduled.

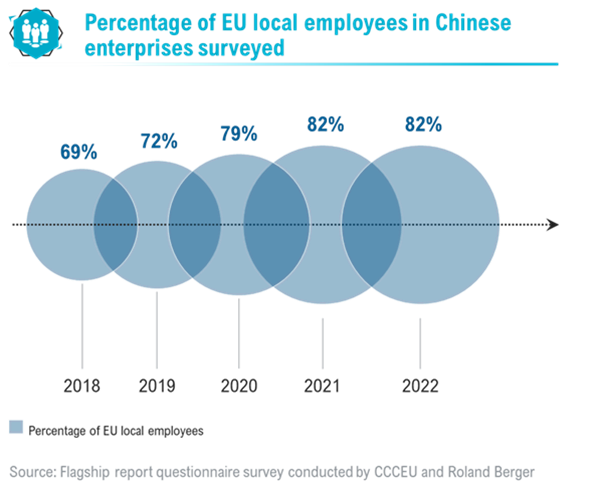

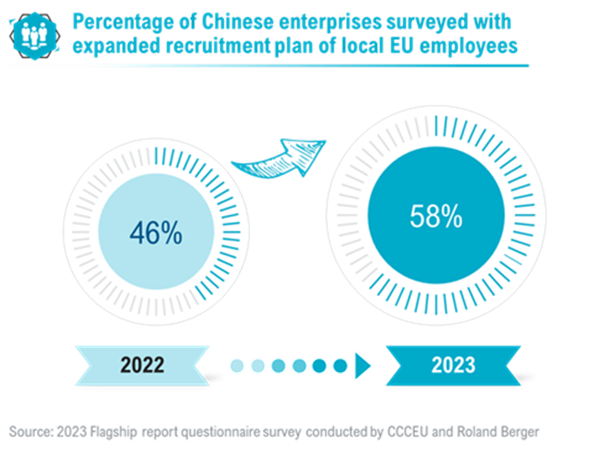

Chinese enterprises continue to provide employment opportunities for the EU. As of the end of 2022, Chinese direct investment enterprises in the EU employed over 270,000 non-Chinese nationals, marking an increase from 250,000 in 2020 and contributing consistently to job creation in the EU. Notably, in 2022, the proportion of local employees in Chinese enterprises in Europe reached a high of 82%, remaining unchanged from 2021. Some Chinese enterprises hire more than 90% of their employees locally. For example, Haitong Bank, a Chinese financial institution owning a full banking licence in the EU, has only 5% of Chinese employees out of its nearly 400-strong team. Piraeus Port Authority S.A., owned by COSCO Shipping, has only 14 Chinese expats among the total 1,015 employees. At the same time, 58% of surveyed Chinese enterprises in Europe expressed plans to further expand their recruitment of local employees in the EU, a significant increase from the previous year's 46%.

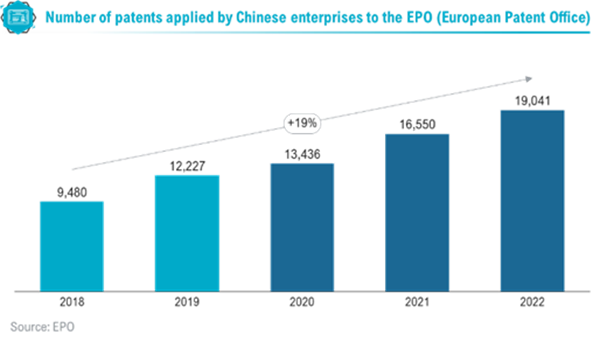

Chinese enterprises in the EU step up R&D investment to promote tech innovation in the EU. The European Patent Office (EPO) disclosed in its Patent Index that the number of Chinese patent applications it received in the year hit a new high at 19,041, representing a year-on-year rise of 15.1%, the largest increase among the top 20 countries of origin for patent applications at the EPO. The patents were primarily concentrated in four major fields: digital communication, computer technology, electrical machinery/instruments/energy, and audio-visual communication. In 2022, Huawei continued to lead the ranking of patent applications at the EPO, submitting a total of 4,505 patent applications.

Chinese enterprises including OPPO, ZTE, Tencent, BOE Technology, Vivo, Baidu, Xiaomi, and CATL are also among the top 50 applicants. Chinese enterprises are always committed to becoming more R&D-intensive in the EU market. According to our survey, 95% of respondent Chinese enterprises maintained or increased R&D investment as a percentage of revenue in 2022. Nearly 88% indicate that they would further raise or maintain R&D investment in the EU.

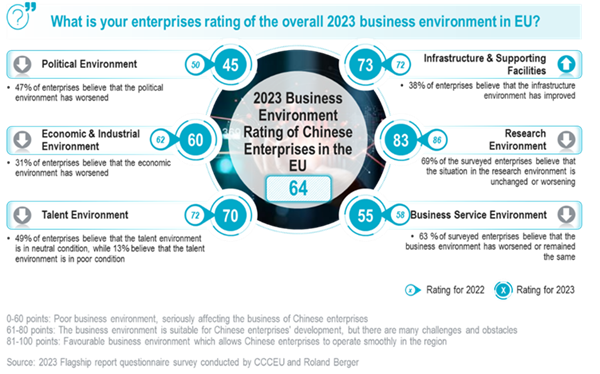

Chinese enterprises' overall rating of the EU business environment dips for the fourth year in a row, but at a slower pace

In the years 2019, 2020, 2021, and 2022, the overall assessment scores were 73, 70, 68, and 65, respectively, with a further decrease to 64 in 2023. Among the six major dimensions, political environment, economic and industrial environment, human resources environment, and business service record varying degrees of decline in rating scores, while research environment's score declined for the first time, and infrastructure and supporting facilities remain largely stable. Some 43% of respondent enterprises believe that the business environment for Chinese enterprises in the EU has deteriorated over the past year.

Despite the downward trend, the decline this year has narrowed compared with previous years, meaning that the overall deterioration in the EU business environment is mitigated. Behind the positive sign are revived mobility and exchanges in the post-pandemic era, which help reduce misunderstandings and reconstruct bridges of communication. And these factors, in combination, have helped Chinese enterprises realise business recovery and encouraged them to resume making long-term strategic plans in the EU market.

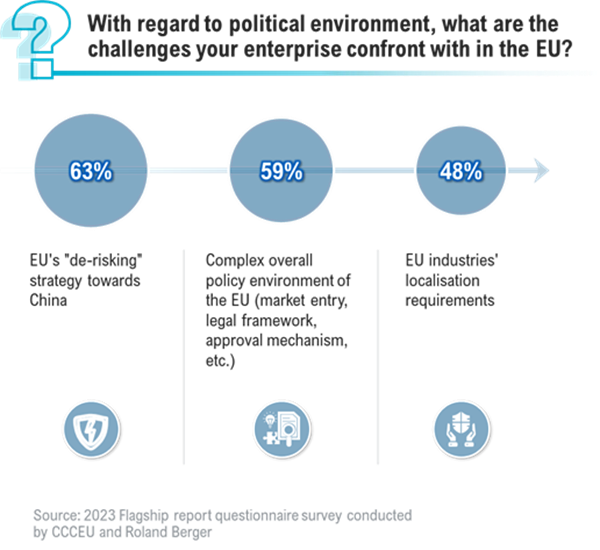

The political environment rating records the sharpest decline, dropping from 50 in 2022 to 45 in 2023. 88% of surveyed enterprises state that they face challenges in the European business environment due to policy issues, with 47% noting a further deterioration in the EU political environment over the past year. They attribute the deterioration to the EU's "de-risking" approach, policy complexity within the bloc, and rising trade barriers. For instance, 63% of respondent enterprises believe that the EU's "de-risking" approach is posing challenges to their business operations. 41% report having experienced losing market opportunities to unreasonable access barriers.

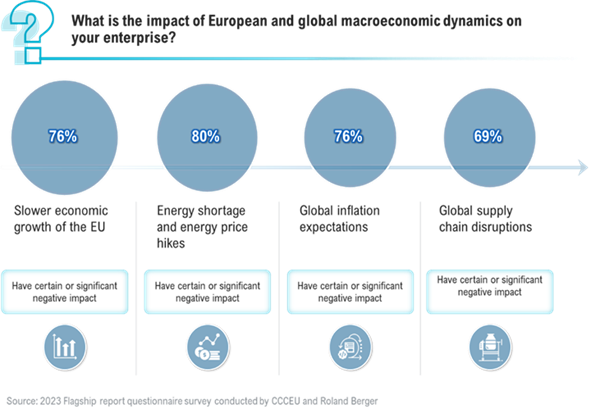

Our survey shows that the rating for the economic and industrial environment in the EU slips to 60 from 62 in 2022. Factoring in faltering economic growth, high inflation, energy price shocks induced by the energy crisis, and supply chain disruptions, 31% of respondent enterprises say that the economic and industrial environment in the EU has deteriorated. Gladly, the decline in rating is attenuated by the better-than-forecast economic performance in 2022, supportive industrial policies, stable value chain, and stable financing environment in the EU, which, together, have spurred the confidence of Chinese enterprises and helped cushion the rating downturn.

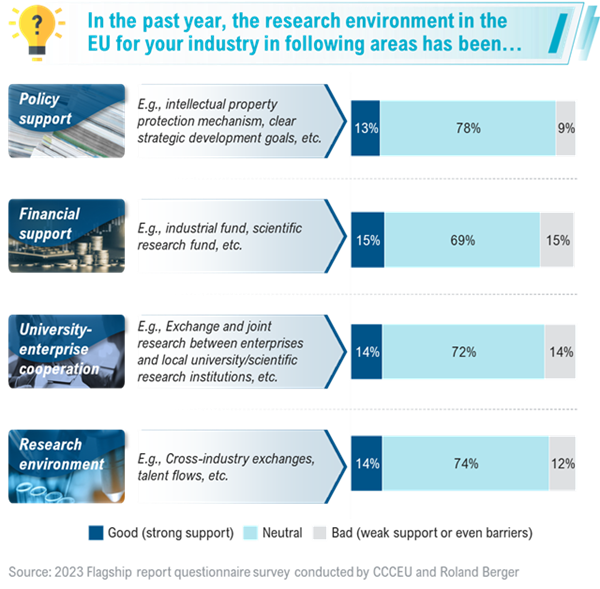

Strikingly, Chinese enterprises in Europe have experienced their first decline in scores for the EU research environment, with a slight drop from 86 to 83. About 70% of respondent enterprises report that they expect the EU to do better with respect to policy support for intellectual property rights protection, funding support for industrial R&D activities, etc. In our survey, a prevailing trend among respondents reveals heightened wariness among universities, research institutes, and corporate entities when it comes to engaging with Chinese enterprises. Notably, in pivotal domains such as semiconductor technology and 5G, some have gone to the extent of excluding or suspending collaborative partnerships.

Talent acquisition and visa obstacles are key challenges. 44% struggle to meet recruitment targets, facing rising labour costs and cross-border talent flow issues in Europe. Surveyed companies also report a 54% difficulty in cross-border talent exchange between China and Europe, attributed to prolonged visa processing times and a decreased willingness to relocate talent. A significant 54% of surveyed enterprises face hurdles in talent exchanges between China and the EU. Challenges include lingering travel restrictions, slow visa processing, and reduced jobseeker mobility even after COVID-19, limiting talent availability for Chinese employers in Europe.

Nevertheless, Chinese enterprises view Europe as the go-to destination for their global strategy. A total of 67% of respondent enterprises in our survey believe that the EU is an important marketplace for them to build a brand image with international recognition. Some 54% of them agree that emerging sectors like digital and green economies in the EU hold remarkable market potential. About 50% report that the sound industrial foundation in the EU will be a powerful source of growth. 83% of respondent enterprises confirm that they will continue to expand their presence.

Chinese enterprises express confidence in the economic and trade prospects between China and Europe. Over sixty percent of surveyed Chinese enterprises maintain an optimistic view of the medium- to long-term economic and trade outlook between China and Europe. They are committed to continually incorporating the European market into their future strategies and increasing investment efforts in Europe, showcasing a firm determination to deepen their presence in the European market.

Report proposes nearly two hundred suggestions

The report puts forward almost two hundred recommendations aimed at advancing China-EU collaboration.

The report suggests enhancing collaboration to tackle global challenges, partnering for global stagflation risk through trade complementarity, deepening cooperation for the global energy transition, and working together to ensure global food security. Additionally, the report highlights the importance of tapping into the potential for bilateral trade growth, adapting and advancing economic and trade structures, and establishing mechanisms for collaboration in third-party markets.

The report calls for fair and transparent incentive policies between China and the EU to support global, green, and sustainable development. Recommendations include the EU carefully handling anti-subsidy investigations on Chinese electric vehicles, fostering communication based on fairness and transparency, and introducing corresponding green energy policies. The report also advises Chinese enterprises in Europe to build sustainable capabilities, seize green transformation opportunities, and integrate ESG into corporate strategies. It suggests setting clear carbon reduction goals, interpreting green policies, and deepening commitment to sustainable development.

The report emphasises the need for China and the EU to promote reciprocal cooperation in the digital industry, fostering mutual benefits. It calls on the EU and its member states to legislate to maintain fairness and non-discrimination in the telecommunications industry, adhere to trade rules under the WTO framework, and oppose trade barriers under the pretext of network security. The report underscores the importance of avoiding future industry and standard decoupling between China and the EU and expresses hope for cooperation in areas such as 5G and 6G.

Additionally, the report suggests that to rebuild trust, bridge differences, and enhance the overall connection, both sides should intensify their exchanges and communication at multiple levels, foster cultural interactions, and reinforce people-to-people relationships. It recommends expanding two-way exchanges between Chinese and European scholars, cultivating diverse and inclusive corporate cultures to earn the trust of local employees, increasing international tourism, and deepening cultural exchanges to foster friendship and mutual understanding.

Login

Login Login

Login CCCEU and Gunnercooke Successfully Host Webinar on CSDDD and FLR Compliance to Guide Chinese Businesses

CCCEU and Gunnercooke Successfully Host Webinar on CSDDD and FLR Compliance to Guide Chinese Businesses Cultivating responsible China-EU business leaders essential to tackling global challenges

Cultivating responsible China-EU business leaders essential to tackling global challenges